In today’s dynamic economy, buying or selling a business is no longer a mere transaction but a strategic step toward financial growth and freedom. "Biz buy sell" is a term that encapsulates the process of purchasing or selling businesses and is a critical aspect of entrepreneurship. Whether you're an aspiring entrepreneur seeking to buy a thriving business or a seasoned owner ready to sell your enterprise, understanding the nuances of biz buy sell is crucial for success.

Every year, thousands of businesses change hands, creating opportunities for both buyers and sellers. However, navigating the biz buy sell marketplace requires expertise, planning, and a clear understanding of valuation, negotiation, and legal formalities. From identifying the right business to ensuring a seamless transition, this guide provides comprehensive insights into how to make your transaction a win-win for all parties involved. By mastering the process, you can unlock a wealth of potential and take the next step toward achieving your entrepreneurial dreams.

This article will delve into the intricacies of biz buy sell, addressing common questions, providing actionable strategies, and offering expert advice. Whether you’re looking to enter the market for the first time or refine your approach, this guide ensures you’re equipped with the knowledge and tools to make informed decisions. Let’s explore the essential elements of biz buy sell and how they can empower you to succeed in today’s competitive business world.

Table of Contents

- What Does Biz Buy Sell Mean?

- Why Is Biz Buy Sell Important?

- How to Evaluate a Business for Sale?

- Key Steps in the Biz Buy Sell Process

- Common Challenges in Biz Buy Sell

- How Do I Find a Business to Buy?

- Financing Options for Buying a Business

- Legal Aspects of Biz Buy Sell

- How to Value Your Business Before Selling?

- Strategies for Marketing Your Business for Sale

- Negotiation Tips for Buyers and Sellers

- How to Ensure a Smooth Transition After Sale?

- Frequently Asked Questions About Biz Buy Sell

- Conclusion

What Does Biz Buy Sell Mean?

Biz buy sell refers to the process of buying and selling businesses. It involves a series of steps, including valuation, negotiation, due diligence, and legal compliance. This term is commonly associated with platforms or marketplaces that connect buyers and sellers, facilitating smooth transactions. The ultimate goal is to ensure both parties achieve their objectives while mitigating risks.

Key Components of Biz Buy Sell

- Business Valuation: Determining the worth of the business being bought or sold.

- Due Diligence: Verifying the financial, legal, and operational aspects of the business.

- Negotiation: Reaching a fair agreement on price and terms.

- Transition Planning: Ensuring a smooth handover post-sale.

Who Benefits from Biz Buy Sell?

Both buyers and sellers stand to gain from the biz buy sell process. Buyers can acquire profitable businesses, while sellers can capitalize on their hard work and investments. For brokers and intermediaries, this process offers opportunities to earn commissions by facilitating deals.

Why Is Biz Buy Sell Important?

The biz buy sell process is vital for fostering entrepreneurship and economic growth. By enabling business ownership transfers, it ensures continuity, innovation, and job retention. Here’s why it plays such a crucial role:

Economic Impact

- Preserves jobs and contributes to local economies.

- Encourages new investments and innovation.

- Provides a pathway for retiring business owners to exit gracefully.

Opportunities for Entrepreneurs

For aspiring entrepreneurs, purchasing an established business is often less risky than starting one from scratch. It provides immediate access to a proven business model, existing customers, and revenue streams.

On the flip side, selling a business allows owners to reap the financial rewards of their efforts, pursue other ventures, or retire comfortably.

How to Evaluate a Business for Sale?

Evaluating a business is one of the most critical steps in the biz buy sell process. A thorough assessment ensures you're making an informed decision and helps avoid potential pitfalls. Here’s how to approach it:

Analyzing Financial Performance

- Review financial statements (income statements, balance sheets, cash flow).

- Analyze profit margins and revenue trends over the past 3–5 years.

- Identify any outstanding debts or liabilities.

Understanding Market Position

Examine the business’s market share, competitive advantages, and industry standing. Consider factors such as customer demographics, supplier relationships, and brand reputation.

Conducting Due Diligence

Due diligence involves verifying the accuracy of the seller’s claims. This includes:

- Inspecting operational processes and systems.

- Reviewing contracts with suppliers, employees, and clients.

- Checking for any legal or regulatory issues.

Key Steps in the Biz Buy Sell Process

The biz buy sell process can be broken down into several key steps. Each step requires careful planning and execution:

Step 1: Planning and Preparation

Both buyers and sellers need to define their goals, gather necessary documents, and seek professional advice to prepare for the transaction.

Step 2: Listing the Business

Sellers typically list their business on online marketplaces, work with brokers, or use their network to find potential buyers.

Step 3: Negotiation and Agreement

- Discuss terms and conditions, including price and payment structure.

- Draft a letter of intent (LOI) outlining the agreement.

Step 4: Closing the Deal

Finalize the sale by signing legal documents and transferring ownership. Ensure all financial and operational obligations are met before closing.

Frequently Asked Questions About Biz Buy Sell

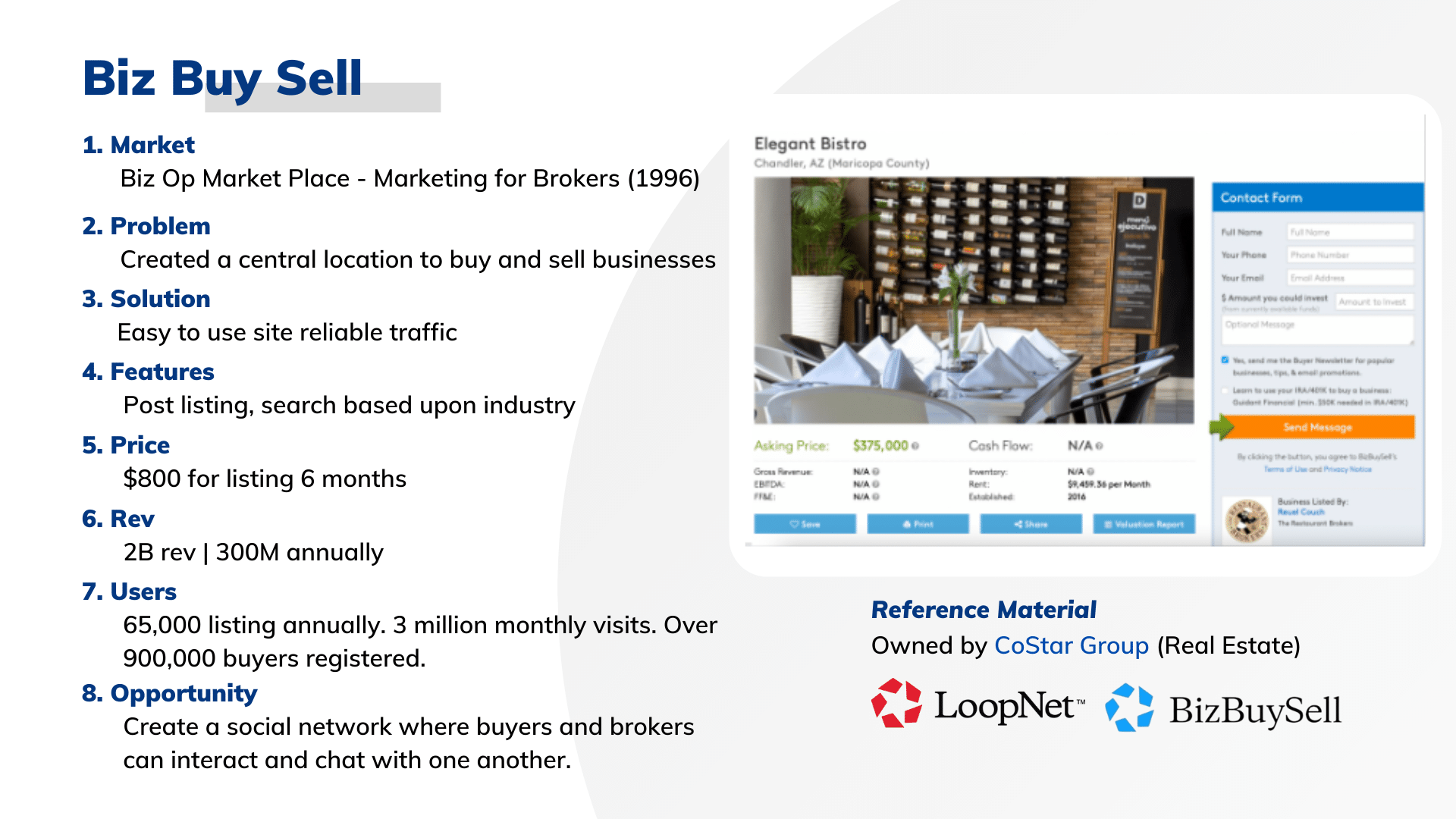

1. What is the best platform for biz buy sell?

Several online marketplaces, such as BizBuySell and BusinessBroker.net, are popular choices for buyers and sellers.

2. How long does it take to sell a business?

The timeline varies depending on factors like market demand, pricing, and business type. On average, it can take 6 to 12 months.

3. Do I need a broker for biz buy sell?

While not mandatory, brokers can provide valuable expertise, marketing support, and negotiation skills to facilitate the process.

4. How can I finance a business purchase?

Financing options include bank loans, seller financing, Small Business Administration (SBA) loans, and private investors.

5. What documents are required for due diligence?

Buyers typically review financial statements, tax returns, contracts, and legal documents during due diligence.

6. Can I sell a business that is not profitable?

Yes, but the valuation and marketability of the business may be lower. Highlighting its potential growth opportunities can attract buyers.

Conclusion

Biz buy sell is a dynamic and rewarding process that opens doors to new opportunities for both buyers and sellers. By understanding the steps involved, evaluating businesses effectively, and seeking professional guidance, you can ensure a successful transaction. Whether you're stepping into the world of business ownership or transitioning to your next venture, the insights shared in this guide will empower you to make confident, informed decisions. Start your biz buy sell journey today and unlock the potential for growth and success!

Article Recommendations

- Understanding L Sec To M3 Sec A Comprehensive Guide

- Pork Blood For Sale A Comprehensive Guide

- Celebritys Height Joel Maddens Stature Revealed